In Daniel Kahneman’s book, Noise: A Flaw in Human Judgement, Mr. Kahneman uses a particularly effective metaphor to illustrate the ways humans make bad decisions. Using the results from a gun range, his main thesis distinguishes between errors caused by bias versus errors caused by noise.

To illustrate bias, he observed the back of the paper target shot with holes, rather than the front of it. If most of the shots skewed left-center, the shooter might actually have impeccable aim…if the bullseye happened to reside there. One could never be certain when only viewing only the back. Or, more likely, the shooter simply had bad aim, with a bias caused by a faulty gun sight or a tendency to pull the shots left.

To demonstrate noise, however, Kahneman found the back of the target with scattered holes displaying no apparent rhyme or reason. The implications were obvious. With bias, the error could be corrected by fixing the gunsight or one’s tendencies. With noise, though, remediation was much harder because the cause itself wasn’t evident. The shooter may have missed the target in each of the examples, but the reason they missed the target could be the result of bias or noise. And unfortunately for investors, bad decisions caused by both bias and noise are rampant in the market.

Noise vs. Bias

Most investors believe, at some level, that they have some capacity for prediction. This confidence can range from the vaguest “gut feeling” to the most precise quantitative models one can imagine. Yet the common theme is prediction.

Noise crumples all those techniques into paper balls and throws them in the trash. Because, in the end, each of those approaches addresses only a bias or a series of biases. None can account for the totality of noise, which goes unseen, by definition, nor can they quantify the amount of noise, which is a secondary issue unto itself. Worse yet, if a manager is successful at mitigating a certain bias for a time, it can create a false positive—the manager will think they conquered noise when, really, they only mitigated a specific or temporary investment bias. The history of the market is rife with managers who are successful in a specific situation but never or rarely repeat their former success.

This is the danger that Kahneman describes so eloquently: the hazard of mistaking bias for noise. If a gambler wins on a lucky roll, they don’t ascribe it to skill. Portfolio Managers, though? They use that winning track record for years, even after their portfolio’s performance has sunk. Through one lucky mitigation of bias, a manager might subject his or her fund (and its investors) to noise for years to come.

Think of it this way: inexperienced investors assume they can take gambles and they will, at worst, break even if their portfolio is up and down a commensurate amount in consecutive years. This is simply not true. Worse, the amplitude of the loss and the harm caused by unfortunate timing can cause an increasing amount of loss. As it relates to bias and noise, a manager might or might not address bias in the short term, but they will likely never address noise in the long term.

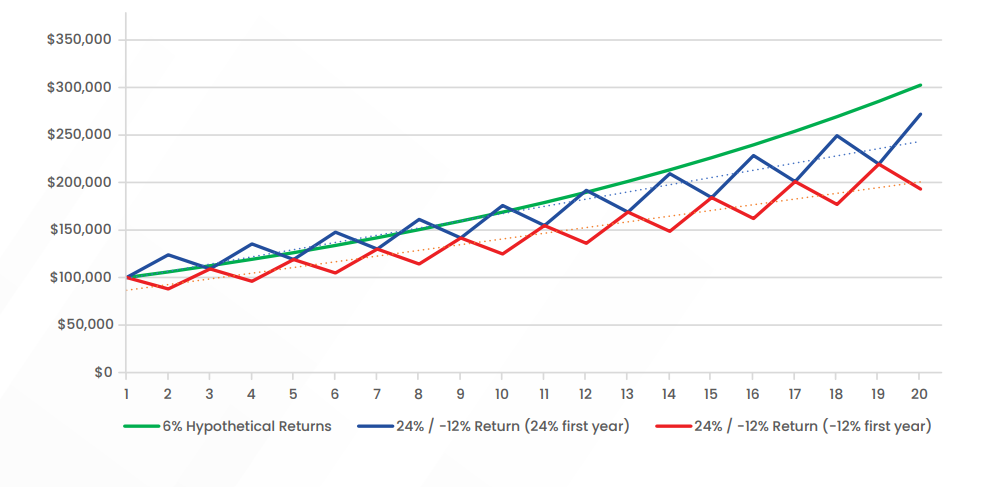

In the chart below, we take a consistent, 6% return on $100,000 over a 20-year period and compare it to alternating annual returns of 24% and -12% (the sum of 12% theoretically equaling two full years of 6% performance). In essence, the blue line is a proxy for a manager that successfully mitigates bias in the short term before reverting to the mean, while the red line represents a manager in the same situation who times the market incorrectly.

Upon cursory view, it’s easy to see that the green line is the winner. What’s more interesting is the divergence between the three lines. If an investor was lucky and mitigated bias in the market correctly the first year, he or she actually remained ahead of the steady 6% trajectory for the first several years. Ultimately, their luck runs out around the 10-year mark, though, and the continuous stream of 6% leaves that investor’s portfolio in the dust. Yet, this is the best-case scenario for such alternating swings. If the investor guessed incorrectly about market bias in the first year, the results are devastating. With that initial $100K dropping to less than $90K, that investor then spends more than four years getting back to where they started. The result? That unlucky investor’s total hypothetical return would dwindle to approximately $193K rather than the approximate $302K in the 6% return scenario, or about 36% less.

How to Mitigate Noise

At New Age Alpha, we don’t attempt to mitigate a specific market bias. Why bother? As market biases change and morph over time, a specific investment approach is bound to run its course. That’s a game of whack-a-mole we’ll leave to other managers.

We mitigate the risk of noise itself.

How? We focus exclusively on the risk of human behavior. We call it the Human Factor, a risk that comes from humans interpreting vague or ambiguous information in a systematically incorrect way. We applied an actuarial-based approach similar to that used by the insurance industry and then developed a proprietary metric to gauge the impact of human behavior. It’s called the H-Factor Score and it represents the probability a company will fail to deliver the growth implied by its stock price.

We don’t try to pinpoint a specific bias that might pull a stock in a particular direction or try to predict that stock’s trajectory. We recognize the inherent futility in that. Rather, we simply gauge the noise surrounding a stock and, if there’s too much, we avoid it. That’s it.

Using the H-Factor Score as the foundation of our investment methodology, we can apply these probabilities to any portfolio or investment universe. We build portfolio solutions that aim to provide a dramatically differentiated and uncorrelated source of outperformance by seeking to avoid mispriced stocks caused by human behavior.

In the chart above, the hypothetical investor thought they could navigate the noise in the market on their own. They were wrong. And worse, if they were wrong from the start, their plight only grew all the more dire. Don’t be that investor. Use our H-Factor Tool to measure the risk of human behavior in your portfolio.

About Us

New Age Alpha is ushering in a new age of asset management by applying an actuarial-based approach to investment portfolios. Utilizing these principles built by the insurance industry, we construct portfolio solutions, indexes, and tools that aim to identify and avoid a mispricing risk caused by investor behavior. Embedding well-established principles of probability theory in our investment methodology, we construct solutions that aim to avoid overpriced stocks in a portfolio. We combine the alpha potential of active management with the advantages of rules-based investing to build differentiated equity and fixed income portfolios that drive long-term outperformance.

DOWNLOAD ARTICLE

DOWNLOAD ARTICLE

DisclosuresThis commentary is accurate as of its publication date (8/13/2024) and has not been updated since its original release.

This document is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. We discuss general market activity, industry or sector trends, or other broad-based economic or market conditions and this should not be construed as research, securities recommendations or investment advice. Investors are urged to consult with their financial advisors before buying or selling any securities. Any forecasts or predictions are subject to high levels of uncertainty that may affect actual performance. Accordingly, all such predictions should be viewed as merely representative of a broad range of possible outcomes.

No client or prospective client should assume that any information presented in this document serves as the receipt of, or a substitute for, personalized individual advice from New Age Alpha or any other investment professional. Any charts, graphs or tables used in this fact sheet are for illustrative purposes only and should not be construed as providing investment advice and should not be construed by a client or a prospective client as a solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice.

Past performance is not indicative of future results. Current and future results may be lower or higher than those shown. An investor in the strategy may experience a loss. Information contained herein does not reflect the actual performance of the strategy. All research and data is simulated and should not be considered indicative of the skill of New Age Alpha. You cannot invest directly in an index. This presentation does not include the deduction of any fees and expenses because an index does not have any such fees or expenses, such as management fees or transactions costs. Investments in securities will generally include fees and expenses that will decrease investment returns. The performance results reflect the reinvestment of dividends and interest.

All New Age Alpha trademarks are owned by New Age Alpha LLC. All other company or product names mentioned herein, including S&P®, Dow Jones®, GICS and MSCI are the property of their respective owners and should not be deemed to be an endorsement of any New Age Alpha product, portfolio or strategy. S&P Dow Jones S&P® is a registered trademark of Standard & Poor's Financial Services LLC (”SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (”Dow Jones”).

The mention of any specific individuals, books, or related references in this article is for informational purposes only. It does not imply any endorsement or affiliation with the mentioned individuals or entities.

H-FactorHuman FactorTM “H-Factor” scores are being provided for illustrative purposes only and should not be construed as providing investment advice or as a recommendation to buy or sell any particular security. Human Factor scores are hypothetical in nature, do not reflect actual investments results and are not guarantees of future results. Human Factor scores measure the probability that, according to the Human Factor algorithm, a company will deliver the growth necessary to support its stock price and are not alone a recommendation about how to invest. The Human Factor is a risk that comes from humans interpreting vague or ambiguous information in a systematically incorrect way. We believe that the Human Factor causes stocks to be mispriced. We measure how the Human Factor affects stock prices to identify which stocks are over or under priced. We apply our methodology to over 5300 stocks and global indexes to identify a risk that impacts stock prices and is caused by human behavior. Investments not included in the H-Factor tool may have characteristics similar or superior to those being analyzed. The accuracy of the Human Factor is materially reliant on the integrity of the information utilized in the calculations, including any assumptions and or interpretations made by the user about the data. Data discrepancies, user assumptions, and data input by user can all contribute to differing outcomes. The underlying assumptions and processes presented herein are subject to change. Furthermore, any Human Factor score referenced herein is a snapshot taken at a particular point in time and any analysis or information contained in such score is outdated and should not be relied upon as investment advice as such information may have materially changed since publication.

© Copyright 2025 New Age Alpha LLC

CC: NAA10337A | SKU: 10204