One of the more iconic scenes in the movie, Moneyball, involves the baseball scouts discussing various players’ abilities. They note a player’s “classy” swing and then move on to his attitude for an assessment of his in-game proficiency. It’s both darkly humorous and a sly indictment of the flawed mechanics by which scouts judge players.

Now imagine those same people were picking stocks for your portfolio. It’s a scary thought. Because this is what you’d get:

You’ll be forgiven if you thought this chart wasn’t terribly informative. Yet the dollar figures on the left axis attest to the sheer amount of money at risk. You see, the blue bars represent the payrolls of the 30 Major League Baseball teams at the start of the 2023 season. Meanwhile, the orange line represents the respective clubs’ records. Most would agree that the correlation isn’t perfect, to say the least. (And if you’d prefer to quibble, please refer to the Note at the end for further discussion.)

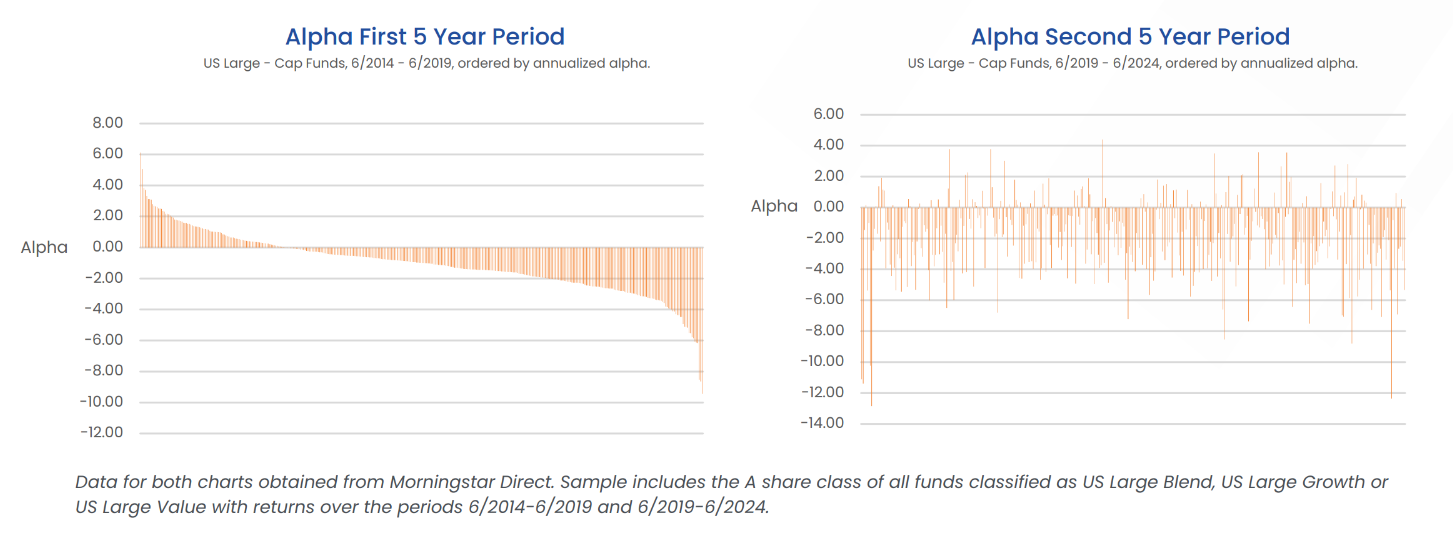

With this in mind, please review these two charts below:

The charts compare the total collection of U.S. Large Cap funds, ranked by annualized return, over one five-year period (6/2014-6/2019) vs. the ensuing five-year period (6/2019-6/2024). The chaos in the second chart is nearly as random as the lack of correlation between the MLB’s team payroll and winning percentage.

It’s as if those same scouts who picked players based on attitude are the same portfolio managers picking investment funds based on previous fund performance. No longer a mere ‘scary thought,’ the similarity takes on frightening reality. Perhaps each should stop trying to pick winners altogether?

Picking Winners is a Loser’s Game

The truth is the people who run ball clubs are a lot like the people who run investment portfolios. They always think in terms of buying the big names in order to put together a winning team. And as you can see, this often leads to failure. We believe this is due to the failure of active stock selection and an imperfect understanding of where alpha comes from.

Billy Beane knew this. The Oakland A’s were struggling but their scouts were using traditional, outdated and ineffective methods to identify talent; it was the only way they knew how to evaluate talent. With a tiny payroll and a burning desire to win, he knew he needed to approach the problem differently. He decided to focus strictly on the data. Rather than attempting to predict the future of a player or buying superstars, he took human judgment out of the equation. Specifically, he focused on a player’s On-base Percentage. The result was revolutionary and the randomness of outcomes was reduced.

In investing, just like in baseball, we believe it’s all about getting things down to a number. Once you have that, you can reduce the vague and ambiguous information—you can avoid investment strikeouts and find value in stocks that many fail to see. The Oakland A’s exploited the On-base Percentage. At New Age Alpha we exploit The Human Factor.

Know the Number

The Human Factor measures the probability a company will fail to deliver the growth implied by the stock price. It’s New Age Alpha’s proprietary methodology designed to systematically measure the amount of vague and ambiguous information impounded into a stock’s price. By putting a number to this risk of human behavior—the Human-Factor—we believe we can measure it and avoid it. In this way, we believe we can produce a differentiated source of outperformance in any investment universe.

Just like baseball’s outdated scouting methods, active stock pickers have always attempted to guess market winners by forecasting the future. Such an approach is archaic, unsystematic, and unpredictable. We believe human behavior is the source from which all traditional risk metrics are born. Beta or PE Ratio do little; they are merely proxies for certain types of risk. If an investor hopes to avoid risk en totale, he or she must look at risk in an entirely new way. Put simply, rather than trying to pick winners, investors should aim to avoid those stocks most likely to disappoint.

Note: Some may contend that there is a generalized successful trend among the top 10 or so teams. As an average, this is true: the top third teams by payroll averaged a W-L percentage of 52.5%, the middle averaged 49.8% and the bottom averaged 47.8%. But this general trend had little predictive power on the best teams overall. The Braves, with the most wins (104), ranked just above the middle with the 11th highest payroll. Meanwhile, the Mets had the highest payroll, but had a losing record. And an amusing sidenote? The eventual World Series winner, the Rangers, had the seventh highest payroll.

About Us

New Age Alpha is ushering in a new age of asset management by applying an actuarial-based approach to investment portfolios. Utilizing these principles built by the insurance industry, we construct portfolio solutions, indexes, and tools that aim to identify and avoid a mispricing risk caused by investor behavior. Embedding well-established principles of probability theory in our investment methodology, we construct solutions that aim to avoid overpriced stocks in a portfolio. We combine the alpha potential of active management with the advantages of rules-based investing to build differentiated equity and fixed income portfolios that drive long-term outperformance.

DOWNLOAD ARTICLE

DOWNLOAD ARTICLE

Disclosures

This commentary is accurate as of its publication date (8/13/2024) and has not been updated since its original release.

This document is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. We discuss general market activity, industry or sector trends, or other broad-based economic or market conditions and this should not be construed as research, securities recommendations or investment advice. Investors are urged to consult with their financial advisors before buying or selling any securities. Any forecasts or predictions are subject to high levels of uncertainty that may affect actual performance. Accordingly, all such predictions should be viewed as merely representative of a broad range of possible outcomes.

No client or prospective client should assume that any information presented in this document serves as the receipt of, or a substitute for, personalized individual advice from New Age Alpha or any other investment professional. Any charts, graphs or tables used in this fact sheet are for illustrative purposes only and should not be construed as providing investment advice and should not be construed by a client or a prospective client as a solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice.

Past performance is not indicative of future results. Current and future results may be lower or higher than those shown. An investor in the strategy may experience a loss. Information contained herein does not reflect the actual performance of the strategy. All research and data is simulated and should not be considered indicative of the skill of New Age Alpha. You cannot invest directly in an index. This presentation does not include the deduction of any fees and expenses because an index does not have any such fees or expenses, such as management fees or transactions costs. Investments in securities will generally include fees and expenses that will decrease investment returns. The performance results reflect the reinvestment of dividends and interest.

All New Age Alpha trademarks are owned by New Age Alpha LLC. All other company or product names mentioned herein, including S&P®, Dow Jones® and GICS are the property of their respective owners and should not be deemed to be an endorsement of any New Age Alpha product, portfolio or strategy. S&P Dow Jones S&P® is a registered trademark of Standard & Poor's Financial Services LLC (”SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (”Dow Jones”).

No ownership claims are made with respect to “Moneyball”, the “Oakland A’s”, or Major League Baseball. All of these marks are the property of their respective owners and should not be deemed to be an endorsement of any New Age Alpha product, portfolio, strategy or service.

Third Party SourcesInformation contained herein has been obtained from sources believed to be reliable, but not guaranteed. It has been prepared solely for informational purposes on an ”as is” basis and New Age Alpha does not make any warranty or representation regarding the information. Investors should be aware of the risks associated with data sources and quantitative processes used in our investment management process. Errors may exist in data acquired from third party vendors.

Human FactorHuman FactorTM “h-factor” scores are being provided for illustrative purposes only and should not be construed as providing investment advice or as a recommendation to buy or sell any particular security. h-factor scores are hypothetical in nature, do not reflect actual investments results and are not guarantees of future results. h-factor scores measure the probability that, according to the h-factor algorithm, a company will deliver the growth necessary to support its stock price and are not alone a recommendation about how to invest. The h-factor is a risk that comes from humans interpreting vague or ambiguous information in a systematically incorrect way. We believe that the h-factor causes stocks to be mispriced. We measure how the h-factor affects stock prices to identify which stocks are over or under priced. We apply our methodology to over 4000 stocks and global indexes to identify a risk that impacts stock prices and is caused by human behavior. Investments not included in the h-factor tool may have characteristics similar or superior to those being analyzed. The accuracy of the h-factor is materially reliant on the integrity of the information utilized in the calculations, including any assumptions and or interpretations made by the user about the data. Data discrepancies, user assumptions, and data input by user can all contribute to differing outcomes. The underlying assumptions and processes presented herein are subject to change. Furthermore, any h-factor score referenced herein is a snapshot taken at a particular point in time and any analysis or information contained in such score is outdated and should not be relied upon as investment advice as such information may have materially changed since publication.

© Copyright 2025 New Age Alpha LLC

CC NAA10291A SKU 10159