As we close out 2021, it feels as if the ground beneath the financial markets has begun to shake. Is this “The Big One”? Is this the San Andreas moment where the Fed finally loses control? Or is it simply another mini-correction, a la December 2018, when the S&P shaved off approximately 500 points before recovering them all (and more) by the end of April? These are the questions on everyone’s collective minds as they try to predict the overall trajectory of the market. But as we all know, the most likely result of increased prediction is increased error. Wild swings up and down in the market practically beg for pundits to stake their claim…which, in turn, only leads to further mispricing. At New Age Alpha, our mantra remains the same. In times of market volatility—or any time for that matter—we believe you’re better off simply avoiding the losers.

LOOKING AHEAD

To be sure, volatility isn’t inherently bad unto itself. It’s simply a measure of price swings, in essence, a standard deviation of returns. And those swings can go up or down. The reason many view volatility negatively, however, is that greater volatility is associated with greater risk. Perhaps these individuals need to examine risk, itself, a little more closely?

You see, in our view, the most problematic part of volatility is that it’s not truly predictive. If volatility only measures the dispersion in a security’s returns, we don’t believe this is synonymous with the full concept and ramifications of risk. Risk, by its definition, should tell you the probability that you will lose money—not your chances of losing OR gaining a lot. This is a very important consideration if the volatility seen in December is apt to continue into 2022. In our opinion, bad metrics lead to bad outcomes.

Currently, the market is facing headline-related risks galore, all involving things that might happen in one macro-economic way or another. For example, the Fed might be forced to raise rates more quickly than expected in order to tame inflation. Or, the latest Covid-19 variant, Omicron, might kneecap the world’s recovery in a totally unexpected way. Or the latest round of stimulus spending in the US might not pass. But the real takeaway of these, and so many other headline-related risks, is that they might, or they might not happen. In our opinion, this is where the risk of human behavior often becomes most pronounced. With so many scenarios and so many pundits incentivized to offer headline-grabbing opinions, a result is an exponential increase in vague and ambiguous information. This is exactly where investors need to be asking the correct question: can a stock deliver?

THE STATE OF THE STOCK MARKET ACCORDING TO THE HUMAN FACTOR

By applying an actuarial-based approach to asset management similar to that used by the insurance industry, New Age Alpha has developed a proprietary risk metric called the Human Factor. We use it to calculate the probability that a company will fail to deliver the growth implied by its stock price. The Human Factor allows us to measure the risk of human behavior in investment portfolios and aim to avoid the losers.

In fact, as it pertains to headline risk and investor appetite for low volatility strategies, we feel the Human Factor methodology is a natural complement to such approaches. Many firms have attempted to deliver Low Vol approaches via a basket of low volatility securities (i.e. limited investment universes) or by additional metrics apart from volatility (i.e. beta, correlation, etc.). In our opinion, however, each has sacrificed performance in the process. The objective of our low volatility strategies is not only to deliver less volatile portfolio returns than the benchmark but to provide returns that exceed those of the benchmark over the long term. This is the Human Factor methodology at work.

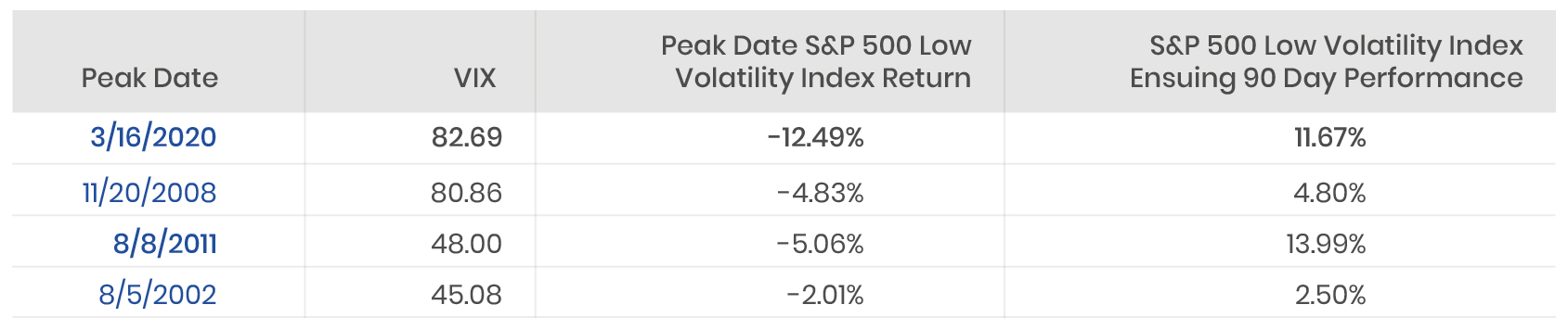

So let’s examine previous periods of intense headline risk where the CBOE Volatility Index, or VIX, has ratcheted highest. In a general sense, the VIX operates as a gauge for the market’s expectations over the coming 30 days but also as an informal measure of fear or risk in the market. For this examination, we’ve isolated four periods since 2002, a twenty-year period. These in order, are colloquially known as the Pandemic of 2020, the Global Financial Crisis, the U.S. debt downgrade, and the WorldCom / Enron scandals following the Dotcom Bust.

Below are presented the individual days within each approximate period where the VIX hit the highest levels, followed by the performance of the S&P 500 Low Volatility Index that day vs. the ensuing 90 days thereafter:

The most immediate takeaway is the contrarian direction of the market following such spikes in the VIX. In each instance, the market gained ground—and sometimes a lot of it—if one was fortunate enough to invest on these precise dates. To be blunt, headline news had little to do with the stock market’s immediate performance. The VIX may measure the amount of fear in the market but, as a predictive performance measure, it appears to need some work.

So far, the VIX highs in December 2021 haven’t rivaled those highs seen in the preceding table. Compared to those peaks sometimes reaching the 80s, the highs at the beginning of the month rose only into the 30s. But the point remains that headline risks should remain firmly there: on the headlines. Volatility, unto itself, is neither a friend nor a foe. But if one can mitigate the risk of human behavior in their portfolio with the correct strategy, the evidence suggests that volatility is nothing to fear.

THOUGHTS ON THE FIXED INCOME MARKET

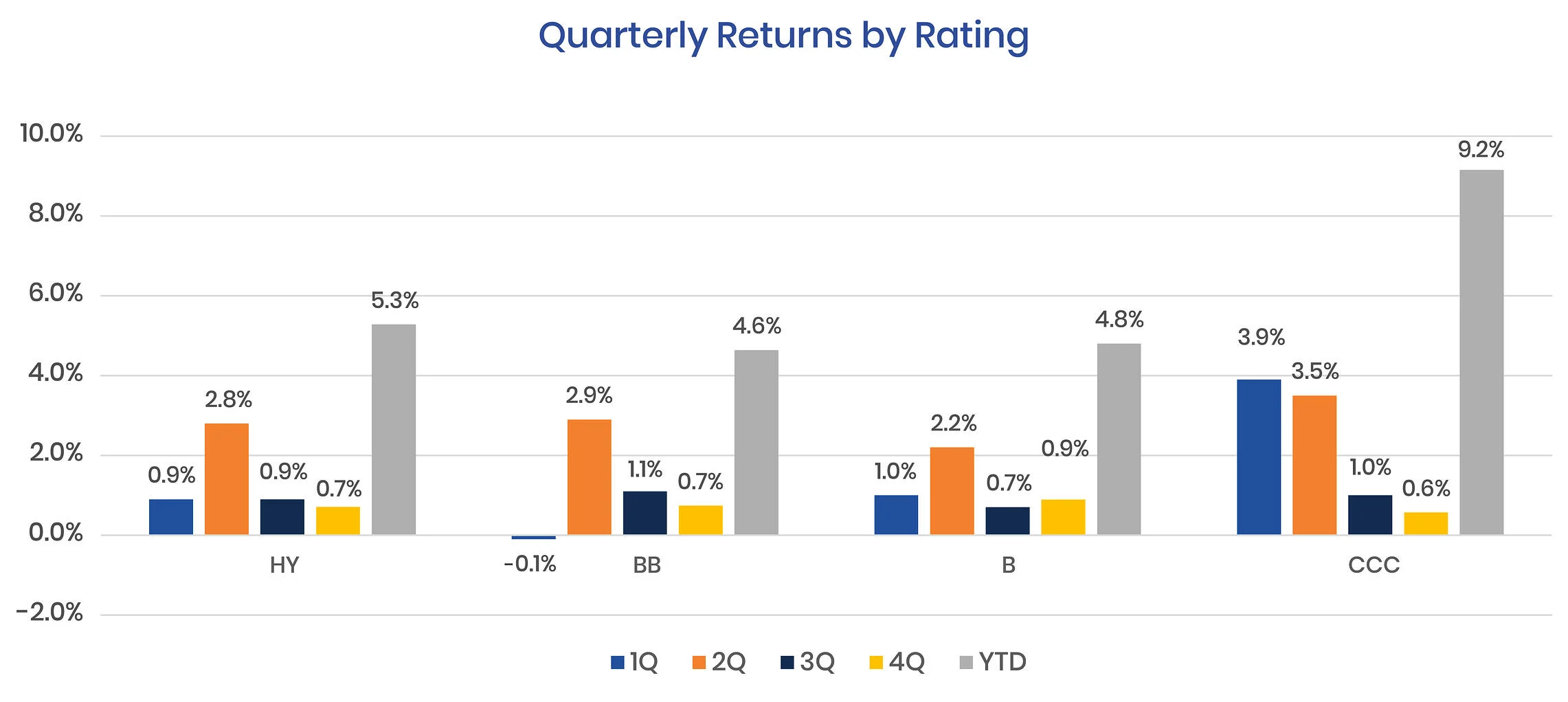

For the year, the Bloomberg Barclays US Corporate High Yield Bond Index was up 5.28% in 2021. We saw CCCs strongly outperform the other rating categories and deliver a 9.2% return, nearly double the rest of the market as BBs and Bs returned 4.64% and 4.80%, respectively. As shown below, the outsized triple-C gains came in the first half while the second half brought roughly even performance for all ratings categories.

Source: New Age Alpha, Bloomberg, LP as of 12/31/21

Similar to the situation in equity markets, the fourth quarter also brought increased volatility. As rates and economic uncertainty weighed on the market, the High Yield Corporate Bond market wasn’t immune. Interestingly, after a weak November, High Yield was able to rally in December and finish the year on a strong note.

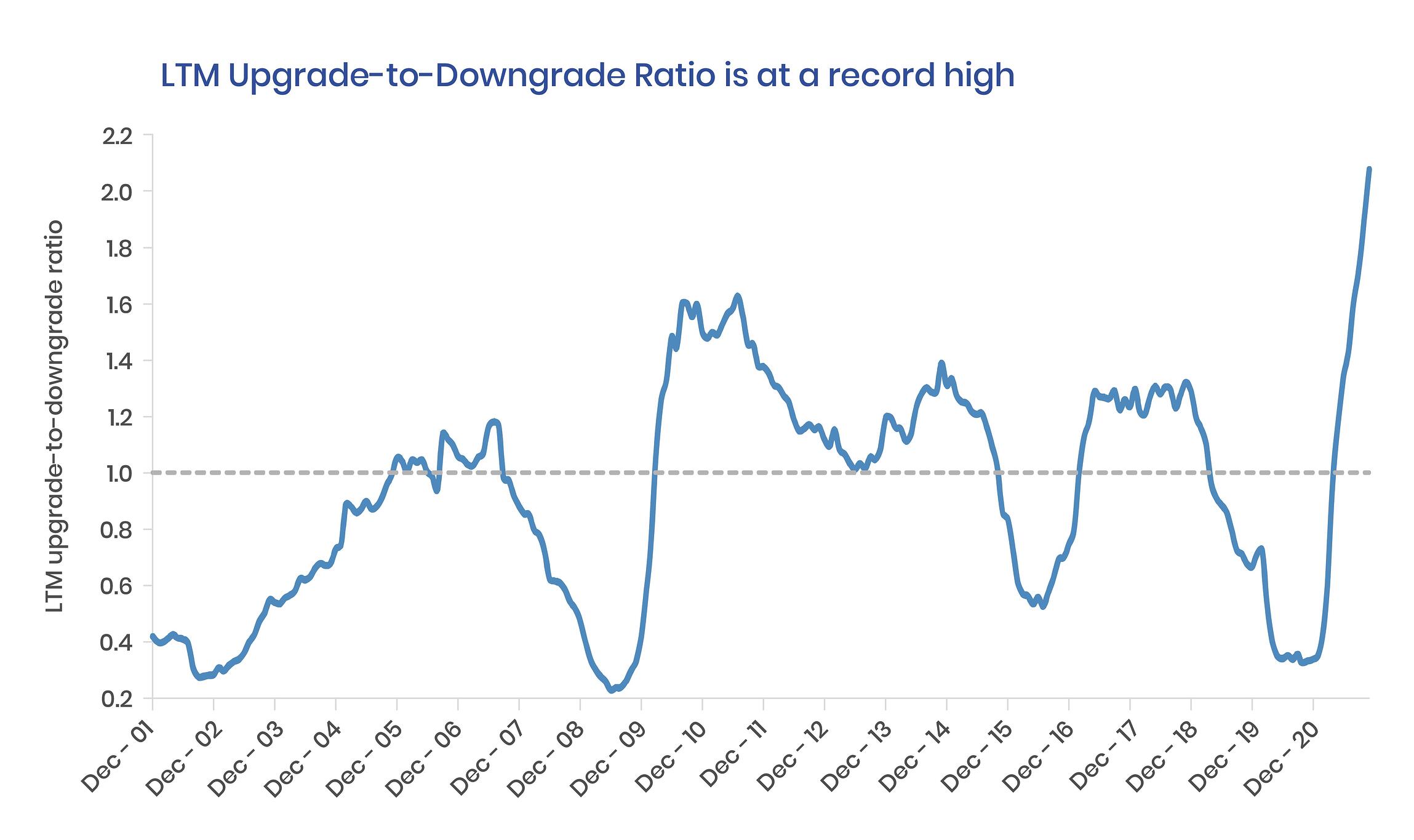

In our opinion, investors drew comfort from the strong fundamental backdrop, with revenue and cash flow numbers helping leverage. Rating agencies agreed, upgrading over $550 billion of HY debt in 2021. Every month of the year saw more upgrades than downgrades and the upgrade-to-downgrade ratio finished the year at a record, exceeding 2:1 for the year for the first time in the history of the HY market. We have also seen very few defaults and the par weighted default rate has fallen to a record low of only 27 bps on an LTM (Last Twelve Months) basis, down a whopping 590 bps from year-end 2020.

Source: JP Morgan, Bloomberg, LP

2021 set another record for HY Bond issuance of $462 billion bonds, exceeding last year’s $450 billion total. Issuance net of refi was also a record at $185 billion. Despite these totals, 2022 promises to be another very active year for issuance with a large portion of the market callable by the end of 2022 and trading at or near the call price.

Despite seemingly solid fundamentals and a benign default environment, our outlook is cautious. Most High Yield strategists and many investors expect spread tightening to largely offset potential treasury rate increases and generate modestly below-coupon returns for the market. This optimistic scenario is fully priced in and translates into high Human Factor risk in our view. We believe a focus on downside risks will pay off for investors in the coming quarters. In this compressed environment, investors are simply not getting paid to take additional credit risk. We believe that issuer selection, and particularly avoiding the losers, will be key to performance.

CONCLUSION

Some have concluded that the word, FEAR, is simply an acronym for False Evidence Appearing Real. As it relates to volatility and fear in the market, this summation feels like it couldn’t be more true. When people grow fearful, they actively search for reasons to confirm this emotion. The VIX, as a proxy for fear in the investment world, has become exactly that. However, a proxy isn’t the real thing and doesn’t guarantee the same results. As we’ve highlighted, it often leads to the exact opposite outcome, in fact.

Why? It’s the risk of human behavior. In moments of distress people often do not make the best decisions. For an investment portfolio, this can be disastrous. The solution is simple then: strip out the vague and ambiguous information and trust only the data. If an investor hopes to avoid this risk, he or she must look at risk in an entirely new way.

About Us

New Age Alpha is ushering in a new age of asset management by applying an actuarial-based approach to investment portfolios. Utilizing these principles built by the insurance industry, we construct portfolio solutions, indexes, and tools that aim to identify and avoid a mispricing risk caused by investor behavior. Embedding well-established principles of probability theory in our investment methodology, we construct solutions that aim to avoid overpriced stocks in a portfolio—losers. We combine the alpha potential of active management with the advantages of rules-based investing to build differentiated equity, fixed income and ESG-themed portfolios that drive long-term outperformance.

Disclosures

Past performance is not indicative of future results. Current and future results may be lower or higher than those shown. It is not possible to invest in an index. An investor utilizing the Human Factor may experience a loss. No client or prospective client should assume that any information presented in this data set serves as the receipt of, or a substitute for, personalized individual advice from New Age Alpha or any other investment professional. All research and data are simulated and should not be considered indicative of the skill of New Age Alpha.

The underlying assumptions and processes presented herein are subject to change. New Age Alpha reserves the right, in its sole discretion, without any obligation and without any notice, to modify the information contained in this material, or to correct any errors or omissions in any portion of this material at any time.

The above statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. The views stated herein are only current through the date stated and are subject to change at any time based on market or other conditions and New Age Alpha disclaims any responsibility to update such views. New Age Alpha may or may not currently own the securities at the times set forth in this article. There is no intention for New Age Alpha to include these securities in its portfolios unless it becomes part of the established universe of eligible securities that are part of each specific investment strategy (e.g. the S&P 500®). It is important to note that there can be no guarantee that the application of the Human Factor to investment portfolios or certain stocks or securities can produce profitable results.

Information contained herein and used in the analysis provided by New Age Alpha has been obtained from sources believed to be reliable, but not guaranteed. It has been prepared solely for informational purposes on an “as is” basis and New Age Alpha does not make any warranty or representation regarding the information. Investors should be aware of the risks associated with data sources and quantitative processes used in our investment management process. Errors may exist in data acquired from third-party vendors.

All New Age Alpha trademarks are owned by New Age Alpha LLC. All other company or product names mentioned herein, including S&P® and Dow Jones® are the property of their respective owners and should not be deemed to be an endorsement of any New Age Alpha product, portfolio or strategy. S&P Dow Jones S&P® is a registered trademark of Standard & Poor's Financial Services LLC ("SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones").

© Copyright 2021 New Age Alpha LLC

CC NAA10265 SKU 10133